sales tax on leased cars in maryland

I doubt Maryland would remit any of the tax unless the original lessee was trading the car in on another new car in Maryland and then they may get a trade-in credit assuming Maryland does this. Vehicles titled in a state with a tax rate equal to or higher than Marylands 6 tax rate will cost 100.

131 Used Luxury Cars In Randallstown Md

In state of Maryland.

. 3 cents if the taxable price is. 1 cent on each sale where the taxable price is 20 cents. If the vehicle is registered in a state that imposes no tax the tax will be assessed at 6 of the value of the vehicle.

Please provide a credible reference to confirm this if possible. Or is the sales tax only on the lease payment portion. Vehicle Registration Tax Credit.

Used Cars for Sale in Maryland. This would be the payment with sales taxes included meaning that 4413 per month was sales tax for this particular payment. Maryland collects a 6 state excise tax on the purchase of all vehicles.

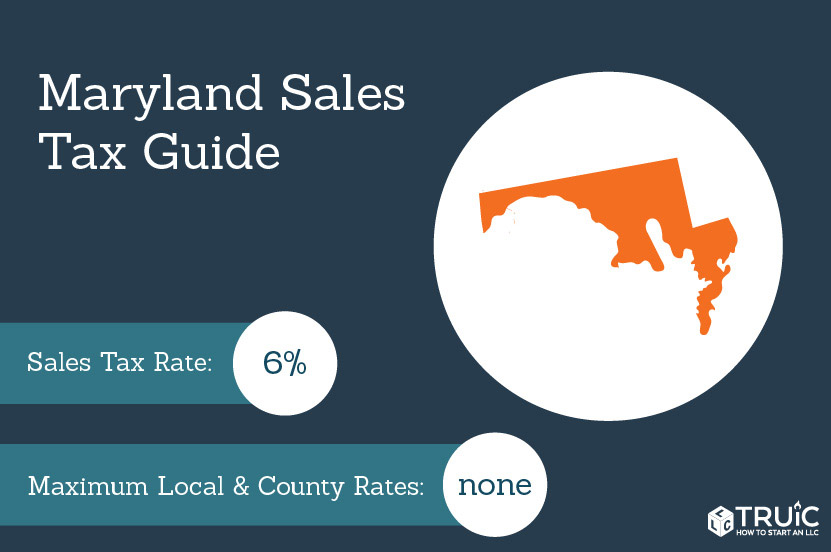

Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows. If the owner is a member of the military on. State Tax Credit for Vehicles and Vessels Benefits.

1 cent on each sale where the taxable price is 20 cents. Multiply the total taxable cost by 006 as the tax rate for Maryland is six. Vehicles from a state with a lower tax rate than Marylands 6 will be taxed at the rate of the difference between the two states.

Maryland sales tax on leased cars - WTF. In Maryland does the dealer charge sales tax on the entire price of the vehicle when leased same as if it was purchased. Military ID or equivalent must be submitted to be eligible for an excise tax credit.

Sales tax on Maryland leased vehicle. And I am being told that for Maryland I have to pay the whole car price in tax IE 22000 price after negotiations x 6 1320. Add taxable dealer fees or other purchases to the total cost of the car.

2019 Previous Generations. Like with any purchase the rules on when and how much sales tax youll pay. The amount you get after that calculation is what you can expect to pay in taxes for the car on top of the purchase price.

However leases for at least one year are considered to be exempt. The total taxes on leasing a car in Maryland were among the highest in the country and three times greater than Virginias rate which encouraged some Marylanders to lease from out-of-state auto. Effective January 3 2008 the Maryland sales and use tax rate is 6 percent as follows.

The potential saving costs for 288 trade-in worth 5000. However leases for at least one year are considered to be exempt. You can calculate the.

This page covers the most important aspects of Marylands sales tax with respects to vehicle purchases. Seems BS to me. Hey Hackers I am considering leasing a vehicle instead of buying it for the 1st time.

Proof of military status ie. To calculate the trade-in tax credit in Maryland you can get the idea from the percentage of trade-in tax credit against your new cars purchaseOn average 575 applies as a car trade-in services in Maryland while purchasing a new car according to new rules and regulations. F20 F21 Model Year.

They dont remit any portion of that to Maryland to cover sales taxes as those taxes have already been paid. 2 cents if the taxable price is at least 21 cents but less than 34 cents. Maryland collects a 6 state excise tax on the purchase of all vehicles.

In the state of Maryland any leases for a maximum of 180 days will be taxed at a special rate. How is sales tax calculated on a car lease in Maryland. Titling Vehicle Purchased by a Leasing Company.

Sales of tangible media property are subject to sales tax in Maryland. Sales of motor vehicles are subject to the maryland motor vehicle titling tax which is administered by the maryland motor vehicle administration. The most common method is to tax monthly lease payments at the local sales tax rate.

In most cases a Maryland dealer handles the titling process as well as the lease agreement and the delivery of the vehicle to the lessee. As a new resident of Maryland you must title your vehicle within 60 days of moving to Maryland. Back to Maryland Sales Tax Handbook Top.

Sales tax is a part of buying and leasing cars in states that charge it. MD 6 VA 4 the. If a leasing company purchases a vehicle through an out-of-state dealer however the company may have to submit the titling documents personally.

With a 24 month lease that increases the monthly by 55. Used car listings in Maryland include photos videos mileage and features. 3 cents if the taxable price is.

For vehicles that are being rented or leased see see taxation of leases and rentals. Multiply the total taxable cost by 006 as the tax rate for Maryland is six percent. Search our inventory of used cars for sale in Maryland at Enterprise Car Sales.

Maryland sales tax on leased cars - WTF. This means you only pay tax on the part of the car you lease not the entire value of the car. Sales tax on leased cars in maryland.

Every used car we sell in Maryland comes with our no-haggle pricing. When paying for the vehicle youll also be charged a 375 percent document fee based on the vehicles overall cost. The price you see is.

For example if your local sales tax rate is 5 simply multiply your monthly lease payment by 5 and add it to the payment amount to get your total payment figure. So if you assume that lease none of that payment represents sales tax. If your car or truck is.

2 cents if the taxable price is at least 21 cents but less than 34 cents. Is the 6 sales tax due upfront on the sale price of the lease car or the lesee pays 6 tax on each payment. E82 E83 E87 E88 Model Year.

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

Nj Car Sales Tax Everything You Need To Know

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

Maryland Car Tax Everything You Need To Know

Nj Car Sales Tax Everything You Need To Know

Sales Tax On Cars And Vehicles In Maryland

Proposed Riverfront Stadium Gets A Name National Car Rental Field National Car Riverfront Nfl Stadiums

A Z Of Maryland Car Tax In 2021 Calculate Tax Bumbleauto

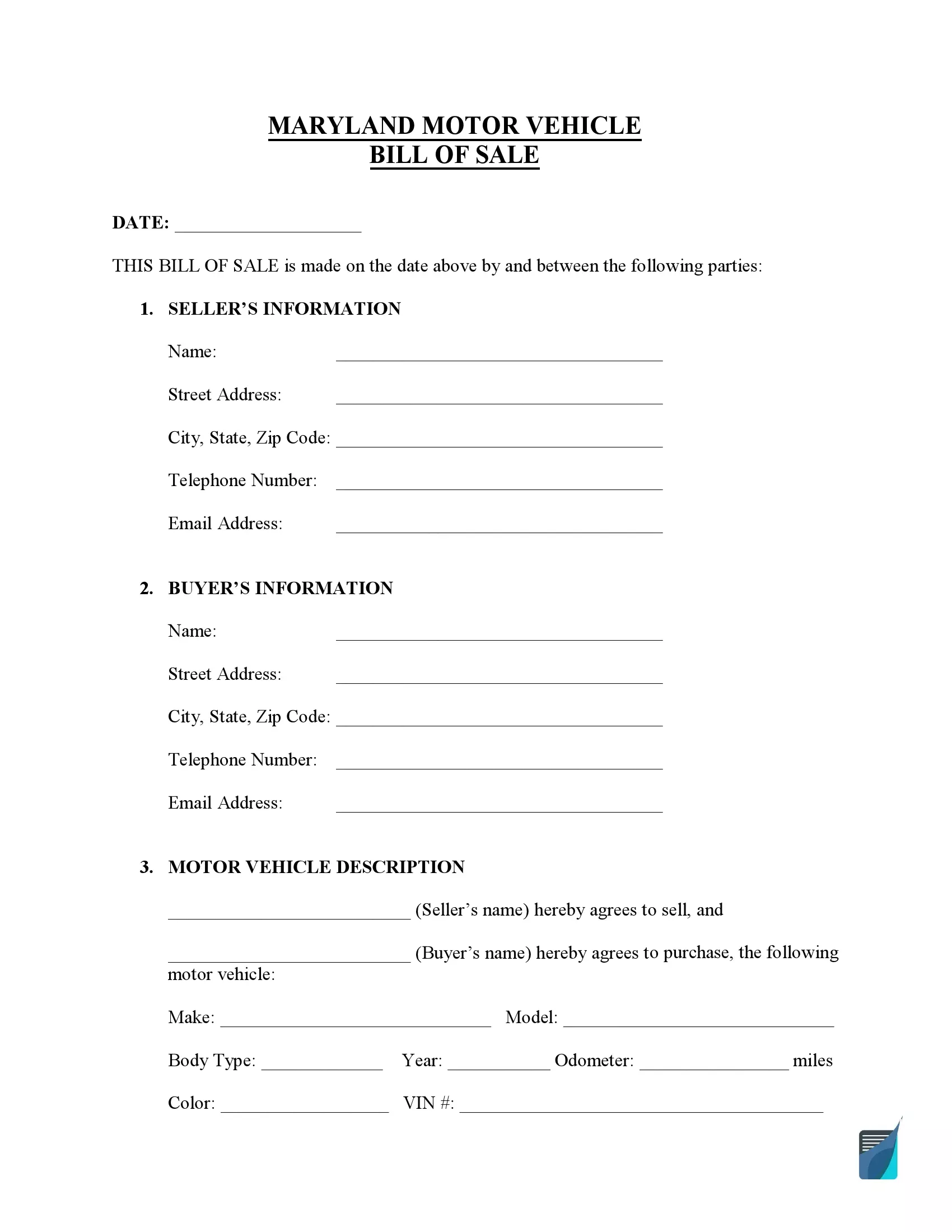

Free Maryland Vehicle Bill Of Sale Form Pdf Formspal

What S The Car Sales Tax In Each State Find The Best Car Price

Register Your Car In Maryland Step By Step Guide Bumbleauto

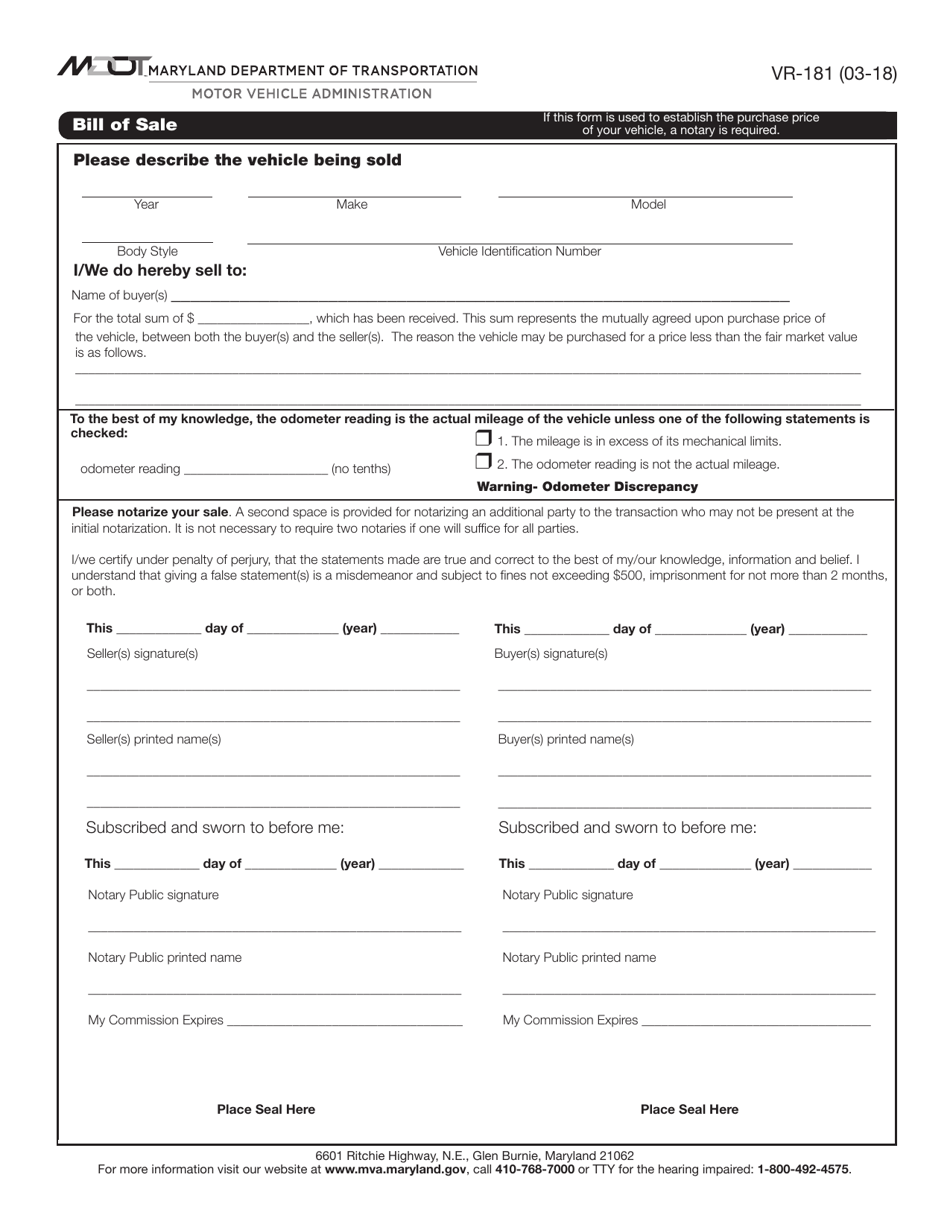

Form Vr 181 Download Fillable Pdf Or Fill Online Vehicle Bill Of Sale Maryland Templateroller

2015 Toyota Camry Review New Car Review Toyota Camry 2015 Toyota Camry Camry

Bike Rental Contract Template Doc Sample

Used Cars In Brandywine Md For Sale

Maryland Sales Tax Small Business Guide Truic

Maryland Residential Lease Agreement Download Free Printable Legal Rent And Lease Template Form In Different Edi Lease Agreement Being A Landlord For Sale Sign

Certificate Of Origin For A Vehicle Template Beautiful Motor Vehicl Contract Template Certificate Of Participation Template Certificate Of Achievement Template